Small business owners, have you ever asked yourself the following questions:

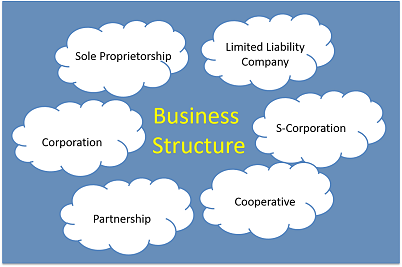

- Should I Incorporate or form an LLC?

- Should I form a C-Corp or an S-Corp?

- Which business structure will get me the most tax savings?

- And what about annual report filings? When and HOW do I file those?

- And how do I keep my company in good standing?

- Do I need governmental approval before I implement the change?

These are all very good questions and they should be answered by a knowledgeable attorney or accountant before you take action and you may want help executing any actions you may want to implement.

Many government agencies may be involved in implementing an initial organization structure or a change in organizational structure. These include the following:

- Internal Revenue Service

- Wisconsin Department of Financial Institutions

- Wisconsin Department of Revenue

- Wisconsin Department of Workforce Development

Other institutions that can be impacted by the initial structure approval or structure change are:

- Your banks

- Your credit cards

- Your insurance companies

- Your retirement account advisors.

If you would like some assistance answering these questions or implementing an initial decision or a structure change for small business owners, Tax Management & Financial Horizons offers a no charge initial consultation during which most if not all these actions can be completed. Don’t get ripped off by Legal Zoom or another website offering to help when we can help you at no charge.

If you are interested in learning more regarding how Tax Management & Financial Horizons can help you call 414 803-3164 to speak with Michael M Sargent CPA or visit our website www.managedtaxes.com.